Table Of Content

If you have a 580 credit score or higher, you may be able to qualify for an FHA loan with a lower down payment (as low as 3.5%). However, the most important thing is to be patient in the process. Check our comprehensive Credit Secrets book now to gain premium guidance regarding increasing your credit score. Suppose you want to purchase a house, and your credit score is 720.

Average credit score of Credit Karma mortgage-holders by generation

A higher LTV is riskier for your lender because it means your loan covers a majority of the home’s cost. Catch up on CNBC Select's in-depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date. Some conventional mortgage providers will lend to those with a credit score lower than 620.

Additional Factors Lenders Consider For A Mortgage

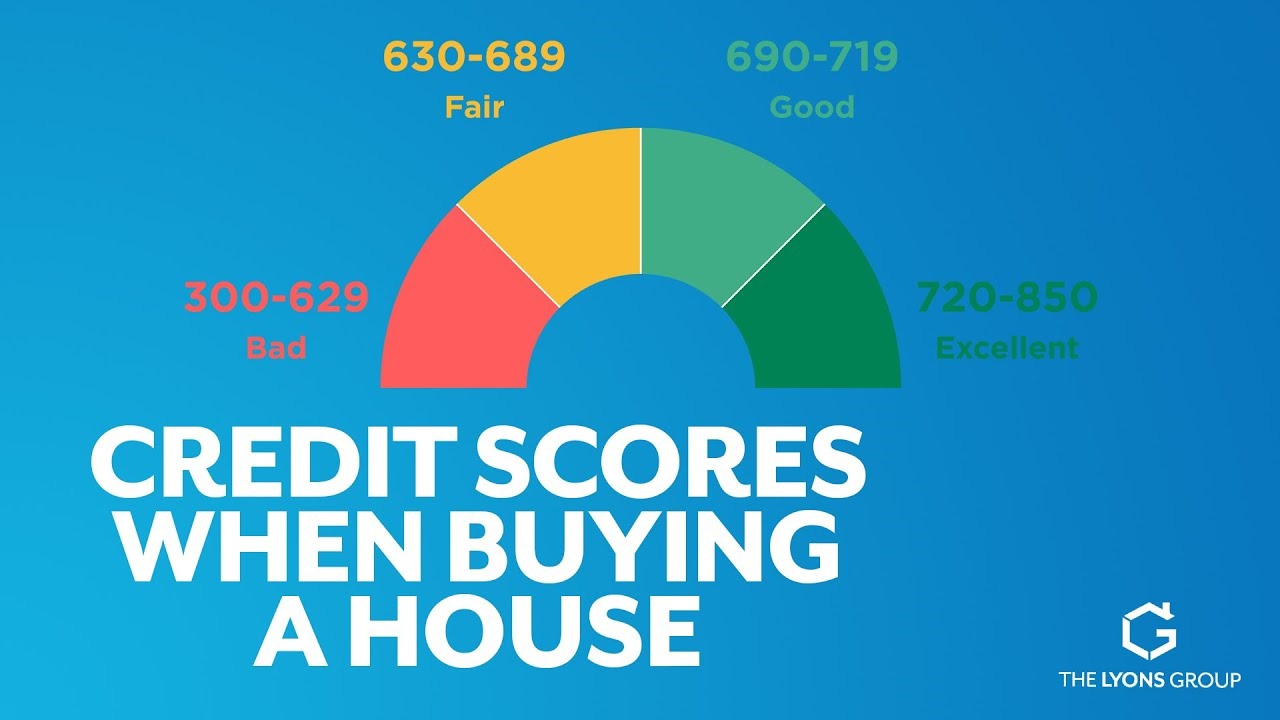

Some lenders will not entertain DTI ratios above 38% and may require a second appraisal. You also need enough cash reserves to cover six to 18 months of mortgage payments. A credit score is a number that tells lenders how likely you are to repay your debts. When you apply for credit, lenders will check your credit score to determine if you’re a good risk. Although there are several scoring models available, most lenders use FICO® scores to assess borrowers.

Cities where Credit Karma mortgage-holders have the lowest average credit scores

Once you know how it all works together, you can build your credit score or maintain it to give yourself the best chance of qualifying for a mortgage. Prospective lenders will pull your credit score when you submit an application to assess your creditworthiness as a borrower. Millennials and Gen Xers are set apart because they have higher average mortgage balances compared to other generations. Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can. Taking a leap and buying your dream home is a very exciting experience.

Here's the credit score you require to buy a home in 2023 — and it's probably lower than you'd think - Yahoo Finance

Here's the credit score you require to buy a home in 2023 — and it's probably lower than you'd think.

Posted: Sat, 18 Nov 2023 08:00:00 GMT [source]

Refinancing a house loan can reduce monthly payments, provide more equity or get you out of debt sooner. However, you will need a good credit score to refinance a house loan. Lenders have different requirements depending on the type of loan you want. You can get a refinance in most cases if you have a 620 FICO score or higher, but there are some options available for people who don’t have the best credit.

Steps To Buying A House

She has over 10 years of experience in online publishing, mostly focused on credit cards and banking. Previously, she was the head of publishing at Finder.com where she led the team to publish personal finance content on credit cards, banking, loans, mortgages and more. Megan has been featured in CreditCards.com, American Banker, Lifehacker and news broadcasts across the country.

See What You Qualify For

Although you can buy a house with a credit score as low as 500, you’ll pay a higher rate and make a larger down payment. You’ll also end up with a much larger monthly mortgage payment, which has a direct effect on the home price you’ll qualify for. Because this lowers the risk for lenders, these loans generally come with lower closing costs, down payment requirements and credit requirements compared to conventional loans.

Bank accounts

How To Get A Home Equity Loan With Bad Credit - Bankrate.com

How To Get A Home Equity Loan With Bad Credit.

Posted: Thu, 18 Apr 2024 07:00:00 GMT [source]

Get matched with a lender that will work for your financial situation. A great house hunting checklist could make the difference between getting the home you want or missing out because another buyer was better prepared. Remember not to overextend yourself with a home outside of your budget, as there are "house to home" alternatives. If things aren't entirely perfect once moving in, a home improvement loan can act as your solution.

You can also talk with your current lender if you are in good standing to get some assistance. Banks will look at the co-signer’s credit profile and financials when reviewing your application. Department of Agriculture (USDA) has similar requirements as other financial products. You need a 620 FICO score and a debt-to-income ratio that is 41% or lower. You will also have to provide proof of citizenship and employment history. USDA refinancing differs from other financial products because you must demonstrate that your income does not exceed 115% of the median household income in your area.

You should resist the urge to apply for more credit cards as you try to build your credit score. New credit applications put hard inquiries on your credit report. Too many hard inquiries can negatively affect your credit score.

You can afford a more expensive homeYour credit score affects both your interest rate and mortgage payment, so it has an impact on how much house you can afford. Try our home affordability calculator to see the difference a few percentage points can make on the home price you qualify for. VA loans are guaranteed by the Department of Veterans Affairs and targeted to veterans, servicemembers and their spouses. Unless you have a lot of money saved up or have a family member with a paid-off house, you’re going to need to get a mortgage buy a house. And since most people don’t have the savings built up to pay cash, you’ll want to make sure that you understand how credit and your credit score can affect your ability to buy a house.

LMB Mortgage Services, Inc., (dba Quicken Loans), is not acting as a lender or broker. The information provided by you to Quicken Loans is not an application for a mortgage loan, nor is it used to pre-qualify you with any lender. Quicken Loans does not offer its matching services in all states. This loan may not be available for all credit types, and not all service providers in the Quicken Loans network offer this or other products with interest-only options.

Texas, on the other hand, has a lot of cities with homeowners who have lower average credit scores. The example also assumes you earn $85,000 per year and have $750 per month in nonmortgage debt. Having a good credit score is important in many aspects of your life. Even though it’s intangible, your credit is one of your most important assets. Your credit score can play an important part in determining what kinds of loans you’re eligible for.

I had some financial issues in the past, and therefore I don’t have a credit score of 700. There are other types of home loans such as FHA insured loans from the Federal Housing Administration (FHA), VA home loans from the U.S. Department of Veterans Affairs (VA) and USDA Loans from the U.S. Department of Agriculture Rural Development (USDA) that allow homebuyers to secure a mortgage with a less-than-optimal credit score. Before applying for a mortgage, you may want to work on your credit scores to help improve your chances of being approved or to better the loan terms you may be offered. California had an unusually high concentration of cities with Credit Karma mortgage-holders who have higher average credit scores.

Like USDA loans, VA loans don’t have a specific minimum credit score. However, private lenders that offer VA loans often set specific minimums of their own, with most requiring a credit score of at least 620. There are also VA lenders that accept lower scores than this — for example, the minimum for a VA loan through Freedom Mortgage is only 550. Department of Veterans Affairs, but lenders typically require a score of 620 or higher. VA loans were created for select members of the military community, their spouses and other eligible beneficiaries.

There’s no single, specific credit score that will automatically qualify you for a mortgage (though having the maximum score of 850 certainly never hurts). However, while lenders might not set precise qualifying numbers, they do have minimum credit score requirements. Jumbo refinances are for properties that do not conform to the limits set by Fannie Mae and Freddie Mac. These loans have higher requirements, such as a 680 FICO score and a 43% debt-to-income (DTI) ratio or lower.